Abakkus Mutual Fund raises ₹2,468 crores during NFO period of its maiden fund

Mumbai, December 31, 2025: Abakkus Mutual Fund has today cited that the new fund offer (NFO) of their maiden fund - Abakkus Flexi Cap Fund, which opened on December 8, 2025 and closed on December 22, 2025, secured assets under management (AUM) with the subscription value of ₹2,468 crores. This is a reflection of strong interest from investors across the country, recording participation from nearly 5,518 pin codes from across 2,000 cities. About 36,688 retail and 1,060 institutional investors subscribed the flexi cap fund during the NFO period. To bring investment inclusivity and business scalability, Abakkus Mutual Fund has built an extensive network of 4,700 empanelled distributors.

Vaiibhavv Chugh, Chief Executive Officer, Abakkus Investment Managers Private Limited said, “Favourable reception from investors across the country for our maiden fund is a testament of strong brand capital of Abakkus Group and trust built through prudent advisory offered by our sales team & distributors during the NFO period of Abakkus Flexi Cap Fund. Our portfolio construction is true to label flexi cap product with diverse spread across market cap classifications and appropriate allocation to the conviction ideas. We will be aiming to launch more funds in the coming years.”

The Abakkus Flexi Cap Fund is managed by Sanjay Doshi, Head of Investments and Research, and re-opened for investments from December 30 2025, available in both regular and direct plans.

Sanjay Doshi, Head of Investments & Research, Abakkus AMC said, “Our flexi cap fund will be aligned to market conditions offering right balance of allocation across large, mid and small caps. The fund will have notable allocation to conviction ideas and will be supported by a well-defined risk management framework aligned to long term wealth creation.”

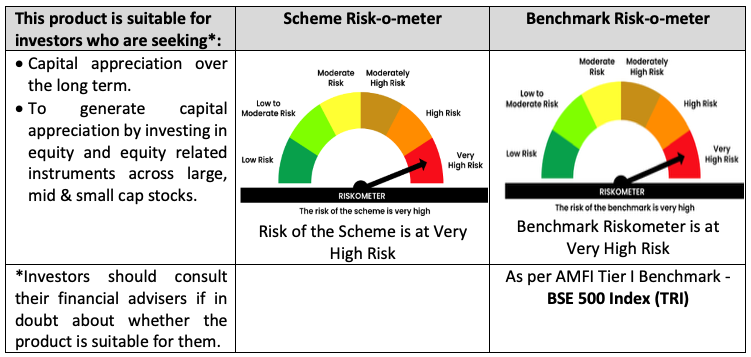

The equity scheme invests across large, mid and small cap stocks, offering portfolio flexibility across market capitalisations. The fund is benchmarked against the BSE 500 TRI and will invest a minimum of 65 percent of its assets in equities and equity-related instruments, with the balance allocated to debt, money market instruments, and up to 10 percent in REITs and InvITs.

All schemes under Abakkus Mutual Fund will follow the in-house MEETS framework, which focuses on Managementpedigree and track record, Earnings quality and the ability of companies to multiply profits, Events/Trends that affect or disrupt operations, Timing of investment at reasonable pricing and Structural aspects like size of the opportunity and competitive positioning.

About Abakkus Mutual Fund:

Abakkus Mutual Fund is sponsored by Abakkus Asset Manager Private Limited (“AAMPL”), a SEBI-registered portfolio manager, investment advisor, research analyst and investment manager across multiple SEBI-regulated AIFs. Backed by Abakkus’ strong investment pedigree, the fund has been set up as a trust under the Indian Trusts Act, 1882, with Abakkus Trustee Private Limited serving as the Trustee. Abakkus Mutual Fund is registered with SEBI vide Reg. No. MF/088/25/14 dated August 29, 2025.

Abakkus Investment Managers Private Limited, a wholly owned subsidiary of AAMPL, serves as the Asset Management Company. As the AMC, the Company will oversee the fund’s operations, including investment strategy, portfolio management and investor servicing. With its evidence-based and research-driven investing philosophy, Abakkus aims to offer differentiated investment solutions to help investors achieve their long-term financial goals.

Source: Registrar and Transfer Agent.

ABAKKUS FLEXI CAP FUND

(An open ended equity scheme investing across large cap, mid cap & small cap stocks)

“The above product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made.”

Disclaimer:

The information contained in this press release is for general informational purposes only and is not intended to be an offer or solicitation for the purchase or sale of any financial instrument or security. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The views expressed herein are the personal views of the individuals quoted and do not constitute investment advice. Past performance may or may not be sustained in the future. Neither the AMC, Trustee Company, Sponsor or its affiliates nor any person connected with them shall accept any liability arising from the use of this document. Investors are advised to read all scheme related documents carefully before investing. Investment in mutual funds involves risks, including the possible loss of principal.

Mutual Funds are subject to market risks, read all scheme related documents carefully.