India > SOEs: The Power of Diverse Owners - Promoter-Heavy to Market-Ready

Various groups, including company promoters, the Government, foreign investors, Indian mutual funds/insurers, and thousands of individual investors, own India's stock market. This mix is an enormous strength. It keeps companies more accountable and helps money reach the best ideas. Unlike China, where many large firms are state-run, India is more market driven.

Tight vs. open ownership

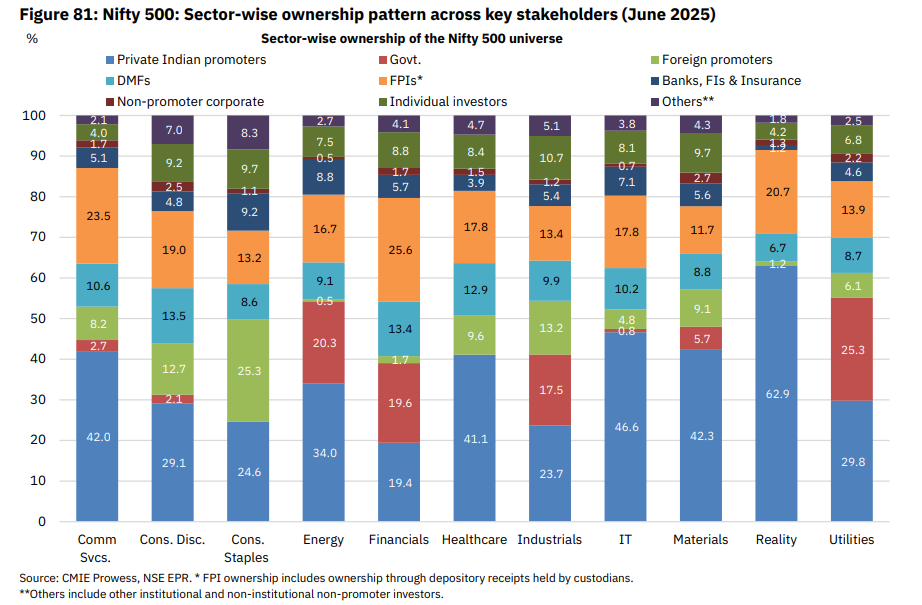

Real Estate and Utilities have the highest promoter holding (around three-fifths). Fewer shares are available for trading, so prices in these sectors can fluctuate rapidly when news or money flows in. Financials (banks, NBFCs) have the lowest promoter holding (about two-fifths). More shares are available, making trading easier and allowing large investors to enter/exit without significantly affecting prices.

Where the Government is present

The Government owns more in Utilities and Energy (for public services like power, fuel, and infrastructure). Industrials have seen a slight rise in Government stake as public capital expenditure grows. In IT, Healthcare, Consumer Staples and Real Estate, Government ownership is extremely low, and business decisions are mostly market-led.

Changing consumption sectors

Consumer Discretionary (autos, durables) and Communication Services show falling promoter stakes. That means more shares are coming into public hands as these sectors mature.

Why these matters

A diverse ownership (promoters, foreign investors, Indian institutions, and retail) usually means better governance and fairer prices than markets dominated by the state. India also has two strong buyer groups: global investors and growing Indian savings (SIPs, insurers). When one slows, the other often supports the market.

How to use this

A float-based position cap protects liquidity and execution, avoiding the fragile quad (High P/E, Low float, Low ROE, Low margins), which protects capital. Combine ownership data (such as 64.1%, 60.1%, and 40.7%) with earnings, ROE, and cash conversion to stack the odds for steady compounding. India's mixed ownership is a long-term advantage and a valuable lens for smarter investing.