India’s Jobs Engine: Broadening, Formalising, Rebalancing

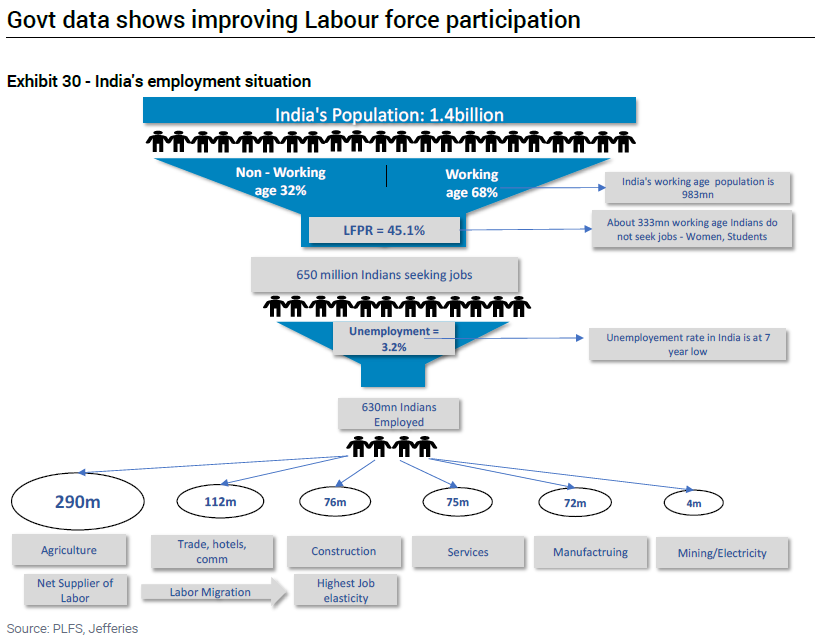

India’s labour market is quietly reshaping. The working-age cohort is 983 million, comprising 630 million employed individuals and 340 million already in non-agricultural roles. LFPR has climbed to a 7-year high at 45.1%, and female LFPR has jumped from 18.6% (FY19) to 31.7% (FY25), a structural positive for growth and household incomes.

What’s changing

- Net new supply moderates: Annual labour additions are likely to slow from ~7-8 million to 5-6 million over the next decade; however, a significant portion of the 290 million agricultural workforce can still transition into higher-productivity sectors.

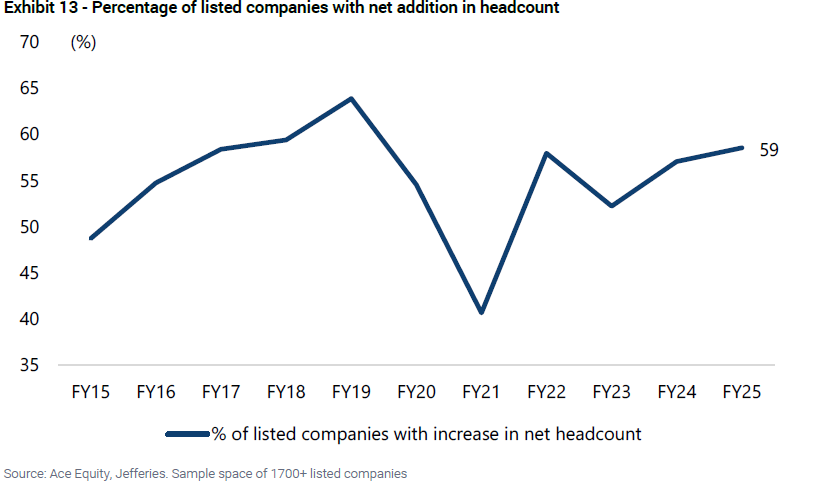

- Corporate absorption is healthy: 59% of listed companies increased headcount in FY25; the top 20 now account for ~50% of listed-company employment, with 16 firms employing 100k+ each.

- The services mix is evolving: Financial services now employ 32% more people than IT; GCC employment in financial services surged by ~80% in six years to 2.1 million (FY25), surpassing the listed IT sector at ~1.8 million.

- Wage dynamics: FY25 pay hikes (~7.4%) were the slowest in a decade (excluding FY21), signalling tighter cost discipline and a focus on productivity.

Why it matters (for investors & employers)

- Productivity kicker ahead: The movement of labour from farms to factories and services can offset slower net supply, sustaining GDP and earnings growth.

- Talent gravity: Financials and GCCs are emerging hiring hubs; HR strategies must rebalance beyond legacy IT pools.

- Concentration risk & opportunity: Hiring concentrated in large caps strengthens execution moats and widens the quality gap within SMID stocks.

- Margin set-up: Softer wage inflation supports operating leverage in FY26, especially for services, BFSI adjacencies, and domestic cyclicals scaling headcount.

- Inclusion dividend: Rising female LFPR is a multi-year booster for consumption, savings, and formal credit penetration.

Actionable takeaways

- Tilt towards businesses benefiting from farm-to-non-farm shifts (manufacturing, construction materials, logistics, retail, financials).

- Track firms with strong hiring/productivity metrics (revenue per employee, training spend, automation) rather than raw headcount growth.

- Watch GCC-heavy office demand, payroll/HR tech, and urban consumption clusters, digital platform plays like wealth, consumption etc as second-order plays.

- Revisit wage-sensitive margin models for FY26; there is a scope for positive surprises where utilisation and mix improve.