More Filers, More Formal, More Future: India’s Low-Tax Growth Model

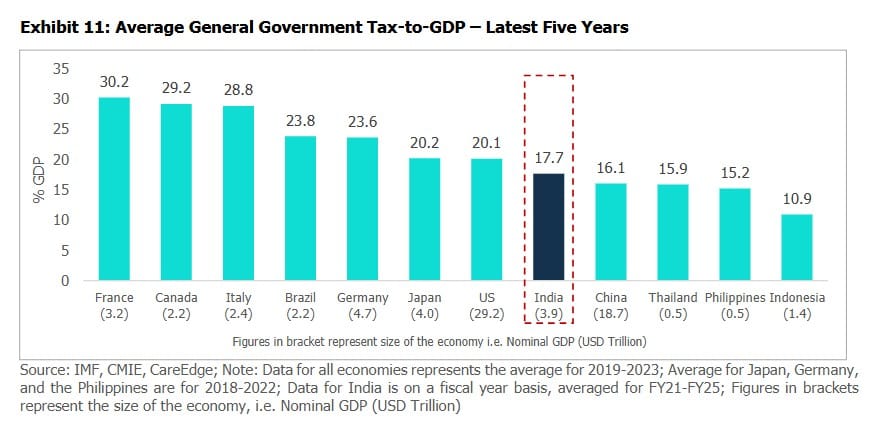

- India’s average general government tax-to-GDP: ~17.7% ($3.9T), markedly below large, developed peers.

- OECD-style economies: France 30.2% (~$3.2T GDP), Canada 29.2% (~$2.2T), Italy 28.8% (~$2.4T), Germany 23.6% (~$4.7T), US 20.1% (~$29.2T).

- Major Asian peers: Japan 20.2% (~$4.0T), China 16.1% (~$18.7T).

- Regional comparators: Thailand 15.9% (~$0.5T), Philippines 15.2% (~$0.5T), Indonesia 10.9% (~$1.4T).

- India’s scale today: $3.9T economy with ~17.7% tax-to-GDP—ample headroom to lift the ratio over time through base widening and compliance, not blunt rate hikes.

India’s general government tax-to-GDP ratio is significantly lower than that of most large economies. Yet growth is resilient and broad-based. The secret is not higher headline rates; it is a broader base, cleaner compliance, and digital rails that keep adding new taxpayers and traceable transactions.

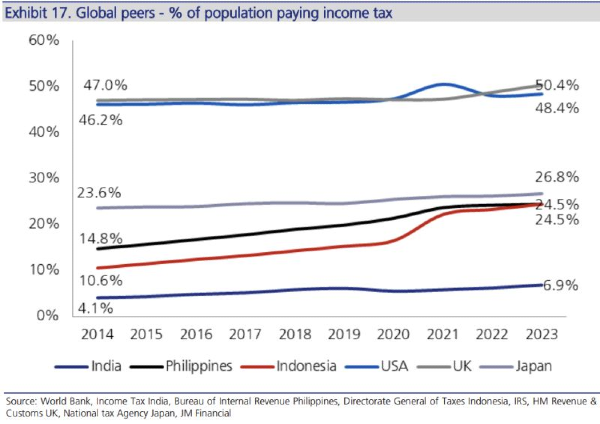

Low taxes and high momentum are not a contradiction; they are a design. India is demonstrating that a competitive GST (blended rate of ~11%) and Personal Income Tax (PIT), combined with digital compliance and public capital expenditure, can deliver both rapid growth today and fiscal headroom tomorrow. As GST collections sustain a $20-21 billion monthly run-rate, ITR filers climb past seven crores (70 million), and more families move up the income ladder, the New India flywheel only spins faster. As the incomes rise, the economy becomes more formal, and the numbers will rise.

We have a long way to go, but the path is clear.