Why Time in the Market Wins for India - Empirical Evidence

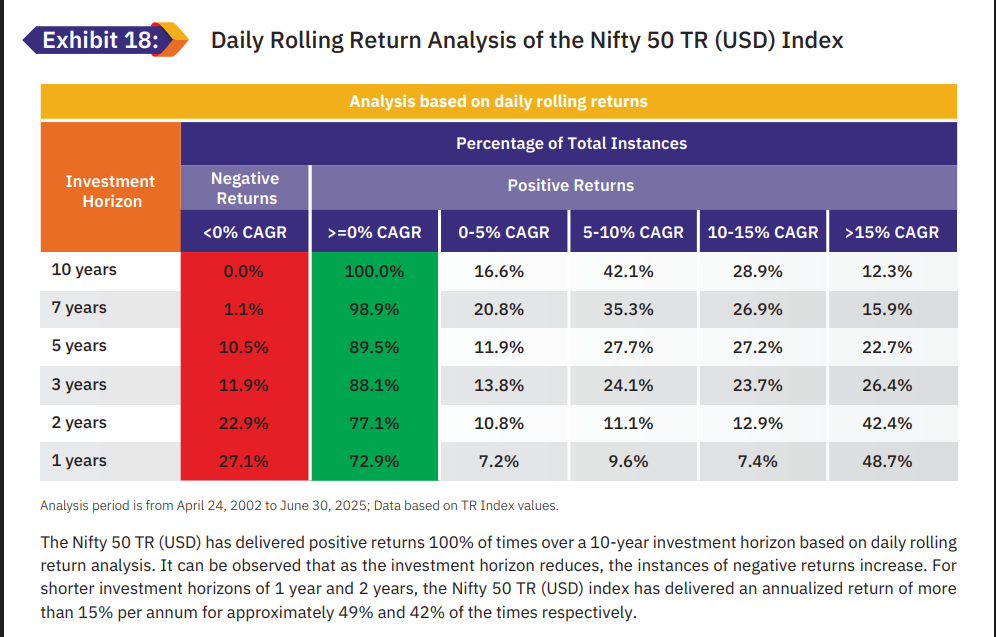

Over 10-year horizons, the Nifty 50 TR (USD) had 0% instances of negative CAGR, meaning that 100% of periods were positive, with most outcomes falling between 5-15% CAGR (42% in the 5-10% range, 29% in the 10-15% range). Even at 7 years, negative (adverse) outcomes were just 1.1%. This is based on the daily rolling return for the Nifty 50 TRI index in USD terms, spanning the period from April 2002 to June 2025, which covers almost 23 years.

Shorter windows are noisier (1-year negative returns of ~27%), but nearly 49% of 1-year periods delivered a CAGR of more than 15%, and 42% of 2-year periods did too. This is despite the Global Financial Crisis, Currency depreciation, Geopolitical conflicts, COVID-19, and Global wars, among other factors.

Source - NSE India

Why does this underpin India’s long-term case?

- Base rates favour patience: Loss odds collapse with time; return bands converge to mid-teens. Frequent churning is likely to incur transaction costs and taxes, and may not necessarily generate additional alpha.

- Earnings engine: Broad earnings growth and high ROE support durable compounding.

- Structural drivers, including formalisation, digital infrastructure, favourable demographics, domestic consumption, financialisation (SIPs), and a capital expenditure (Capex) cycle, deepen market breadth.

- Process > Timing: Given skewed long-horizon outcomes, disciplined investing will consistently outperform market timing.

Takeaway: In India, the data shows that rewards favour those who stay invested in the market - owning quality, seeking growth, following fundamentals, and staying in the market, allowing time to compound and drive structural growth in the market.